EY and Harvard Law School’s Center on the Legal Profession have collaborated on a survey and series of reports on developments in the legal industry. The research focused on the changing needs of large corporations and the challenges faced by legal departments in meeting those new demands. The research was based on interviews with more than 2,000 business leaders from 17 industries and 22 countries across the globe.

The research, by focusing on CEO priorities and working backwards from there, zeroes in on contracts and the contracting process as the source of many of the challenges, and the opportunities, for today’s legal departments.

What’s even more clear is that the data shows a clear shift in the way organizations are viewing contracts - a shift from a process orientation that emphasizes costs and efficiency, to a data-centric view of contracts, that treats contracts as a resource and asset that can be used to generate insights and value, and drive new business.

The Squeaky Wheels

The first report in the series, called The General Counsel Imperative: How do you turn barriers into building blocks?, sets out the perspectives of corporate management on their biggest challenges and priorities. The greatest areas of concern are:

- Risk management

- Contracting inefficiencies

- Cost management

- Technology and process investment

- Delivery methods.

All of these challenges are related, and center on contracting processes. Companies need to know what risks and opportunities lie in their contracts (risk management); 50% say process inefficiencies in contract processes have cost them money (contracting inefficiencies) but that workloads are only increasing (cost management); this leads them to want to fix things with technology (tech and process investment); and they don’t know if their law departments are effectively using outsourcing, co-sourcing, in-sourcing and self-help, or outside counsel effectively in their contract management (delivery methods).

CEO Priorities, Through the Lens of Contract Data

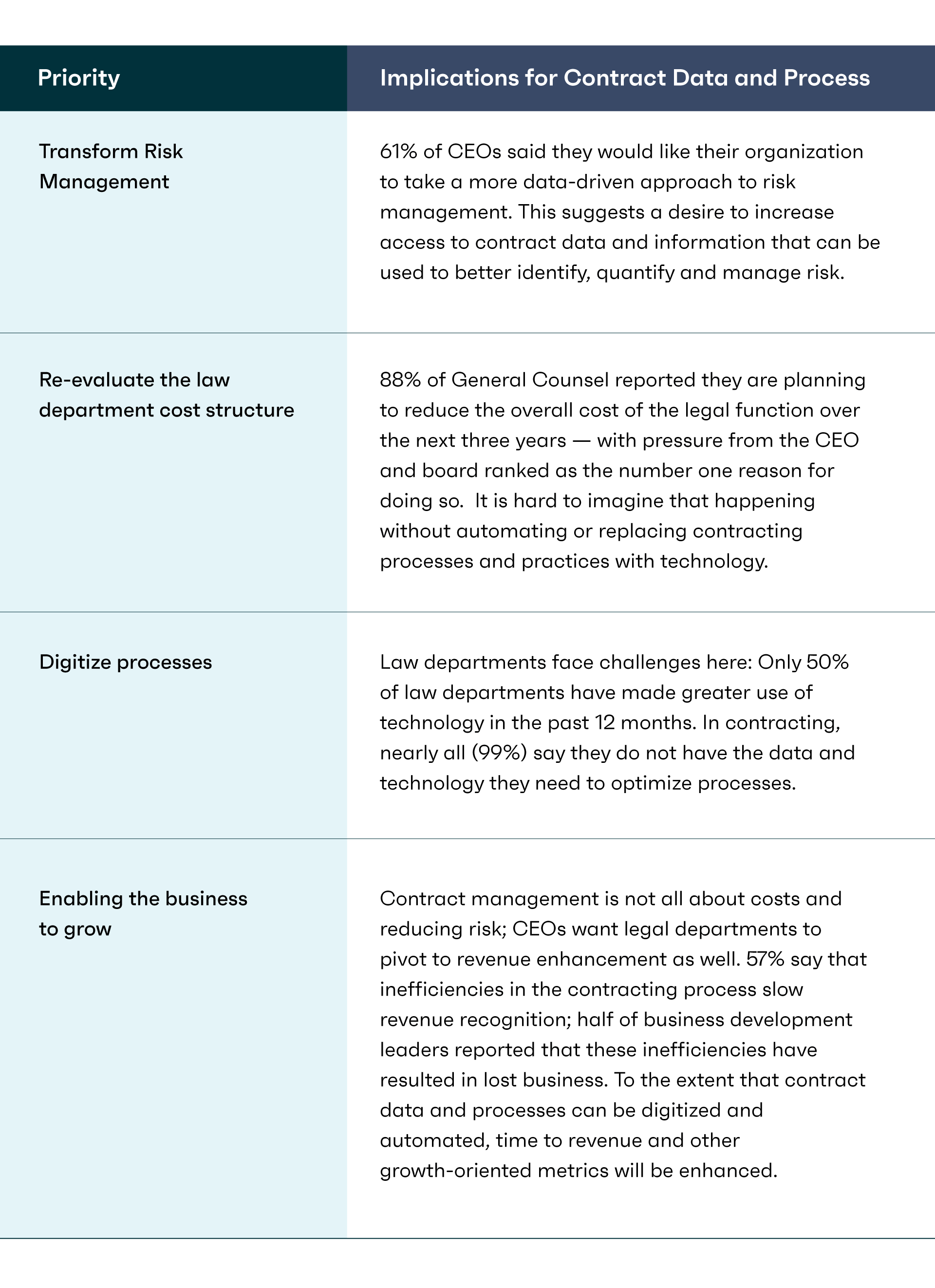

The report draws on a separate EY study, the CEO Imperative Study, that identified four key priorities that are highly relevant to GCs and law departments. Significantly, all four priorities have implications for the ways that organizations manage their contracts and the data contained within them.

From a Process-Centered to a Data-Centric View of Contracts

If today’s organizations are to get the maximum value out of their contracts, simply speeding up existing processes is unlikely to be sufficiently responsive to all of the CEO priorities outlined above. The implications of the trends above for contracting practices are outlined in a second report, The General Counsel Imperative: How does contracting complexity hide clear profitability? It acknowledges the transformational change underway in technology adoption, strategic alignment, and talent/sourcing aspects of contracting practices today:

“Sixty-one percent of CEOs want a more data-driven approach to risk management, in which digital platforms play a critical role in centralizing and streamlining the creation, storage, retrieval and analysis of contracts.

Organizations have a large gap to close in achieving this vision. Ninety percent of organizations report having difficulty locating contracts because they don’t have the necessary technology or processes. Seventy-one percent say they don’t have the technology to monitor contracts for deviations from standard terms, and seventy-eight percent say they don’t systematically track contractual obligations.”

Process improvements can break up some of the contracting bottlenecks that hinder effective use of contracts, but other technologies will be required to go beyond process to insight. AI-based contract analysis tools will be needed to fully leverage contract data at scale. Such tools can monitor contracts for obligations, and create real-time feedback loops to monitor ongoing negotiations for consistency with organizational playbooks and standards.

A Sea Change in the Value of Contract Data: Implications for Law Firms

Corporate clients are coming around to this new view of the value of contract data to their ongoing financial health and growth prospects. Much of the transformation in this space will take place inside those corporations, in law departments, in procurement, in sales, in finance and in risk management.

But EY is quick to point out that the work of helping in-house legal teams manage those changes is increasingly falling on a wider legal ecosystem, including ALSPs like EY, but also encompassing new legal operational roles including data analysts and process managers, and legal technology providers that are building the systems on which the new practices are built.

Harvard and EY recently held a half-day webinar to present and discuss the results of the EY survey (The New Legal Function: 360 Degree Insights for Law Leaders). In a panel that addressed this widening ecosystem, Moderator David Wilkins of the CLP posed a pointed question to Bas Boris Visser, Partner and Global Head of Innovation and Business Change at Clifford Chance, as the lone law firm representative on the panel: In this transformation that involves data and technology, and requires a great deal of operational rather than legal expertise, what does a law firm bring to the table?

Visser’s response was that law firms simply can’t go it alone in that transformation; they will have to become collaborators with the other players in the ecosystem and adopt the standards of the ecosystem, rather than generating one-off solutions. He used large re-papering projects as an example, where regulatory changes might require thousands of agreements to be amended and altered. Who is best to handle that work? The law firm that knows the business and its relationships well? The managed service provider with the operations and technology chops to get the work done efficiently? The technology provider? The in-house team? The answer that clients are increasingly asking for, says Visser, is “all of the above” - the ecosystem has all the capabilities that are needed if the players agree to cooperate and adopt common standards around the work, and get the right work into the right hands.

To put it slightly differently, the implications of the findings of this research is that law firms need to go beyond chasing the next deal, become more strategically embedded in their clients’ contract digitization processes, and get comfortable with partnering across this new ecosystem where that work will be carried out.