With the world becoming increasingly interconnected, firms are finding themselves more reliant than ever on automating legal processes and new technology tools. Clients are placing increasing pressure on firms to meet rising expectations, and a new generation of legal professionals are willing to rethink the conventional way of doing business.

We recently assembled a panel of experts, from the US, UK and Canada, who discussed how their firms are changing to meet this challenge and what we can learn from colleagues around the world.

Steve Obenski, Chief Strategy Officer at Kira Systems hosted Ben Hunt, Legal Tech Manager at DLA Piper; James Côté, Legal Technology and Innovation Specialist at Bennett Jones; and Nicola Shaver, Managing Director of Innovation and Knowledge (Global) at Paul Hastings.

Watch the session on-demand now.

Business Model Innovation

Innovation is not all about technology; a recurring topic was the many ways that legal service delivery is changing its service models, delivery programs, and business structures in order to adapt to new demands. Among the business model innovations discussed were:

- Firms building “Captive ALSPs” - a recent study found that 35% of the AmLaw 100 firms have some sort of captive entity or ALSP (Alternative Legal Service Provider) for high-volume, process-oriented work that might otherwise be outsourced elsewhere.

- Firms creating software and consulting lines of business - examples include Reed Smith’s Gravity Stack, which is developing and selling technology outside the firm; Mishcon De Reya is providing tech consultancy and legal engineering services through its MDRxTECH unit; DLA Piper’s “Law&” unit offers design, legal process improvement, and automation services to clients, among other things.

- Firms crossing into other disciplines - many are offering additional professional services including finance and accounting.

- Firms “productizing” their offerings - leveraging technology to create client-facing portals and chatbots to automate self-service delivery of legal expertise.

- Formal customer-facing innovation programs.

Uneven Tech Adoption

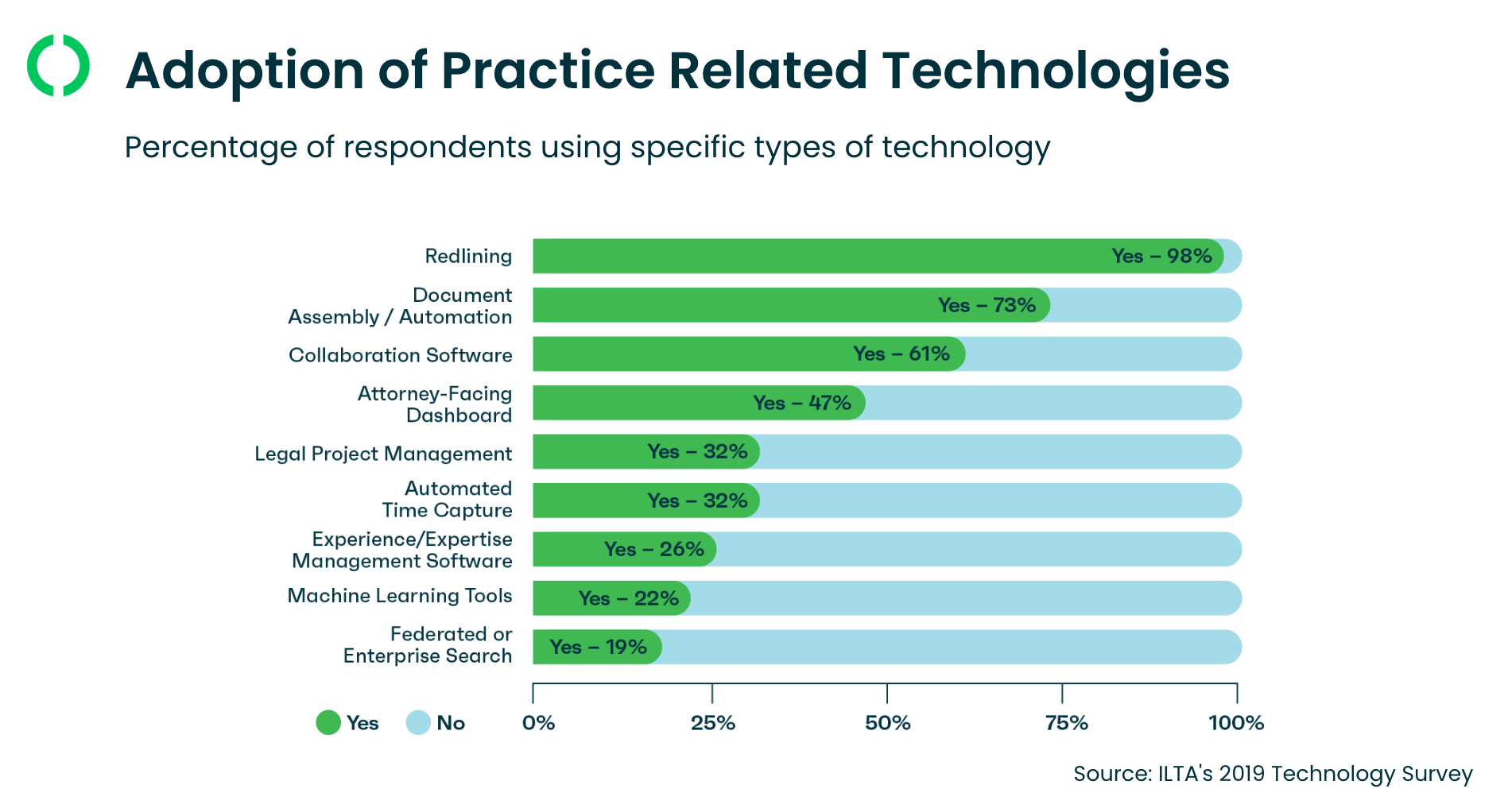

Obenski presented the results of recent research from the 2019 ILTA Technology Survey, which showed uneven distribution of legal tech adoption by type of application. Tools like redlining and document assembly software have relatively wide adoption, but some of the newer technologies and applications like machine learning or even project management software have been adopted by relatively few. Since the webinar, ILTA has released its 2020 version of the study, and use of collaboration tools has increased from 61% to 78% of respondents.

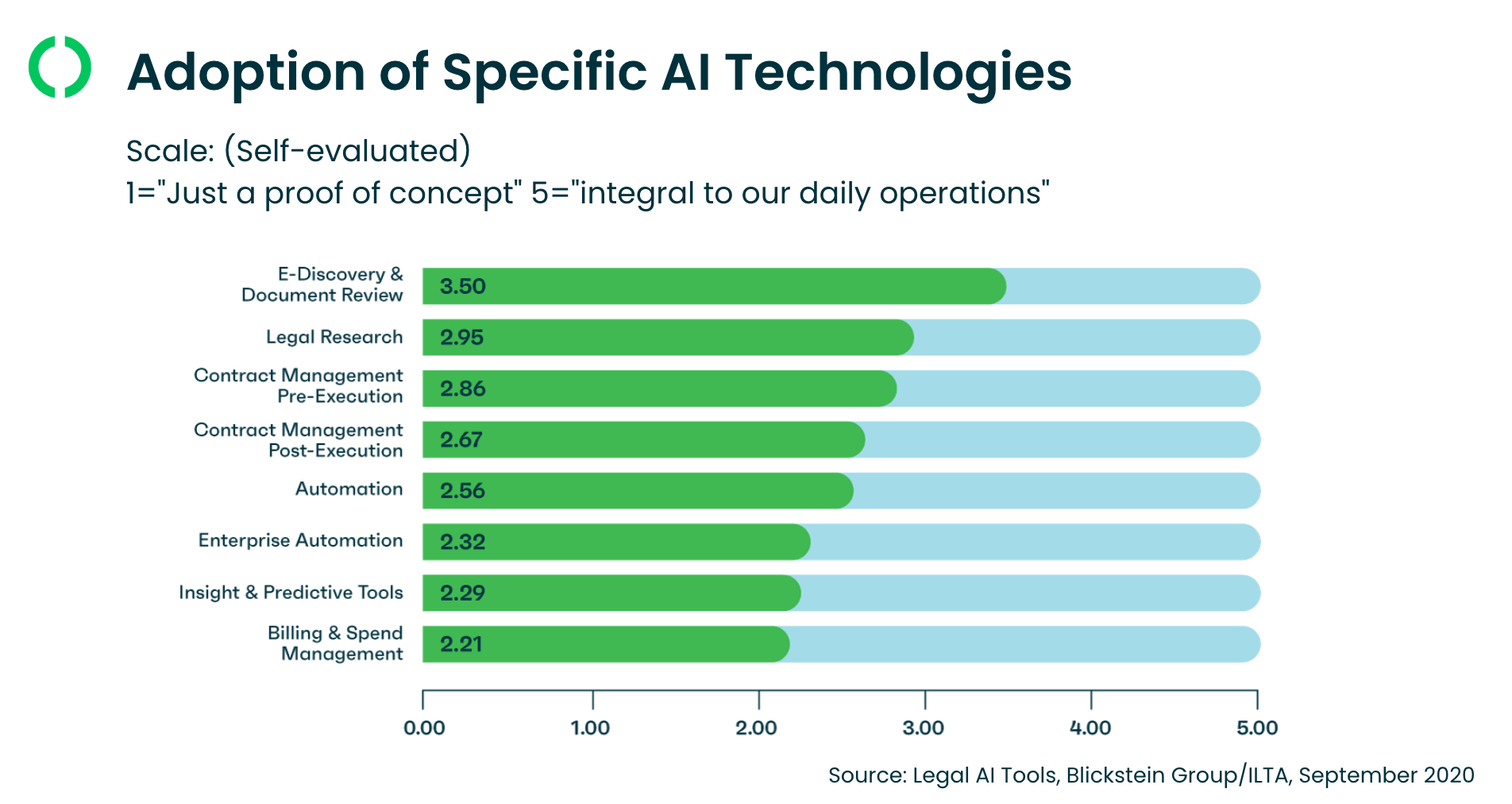

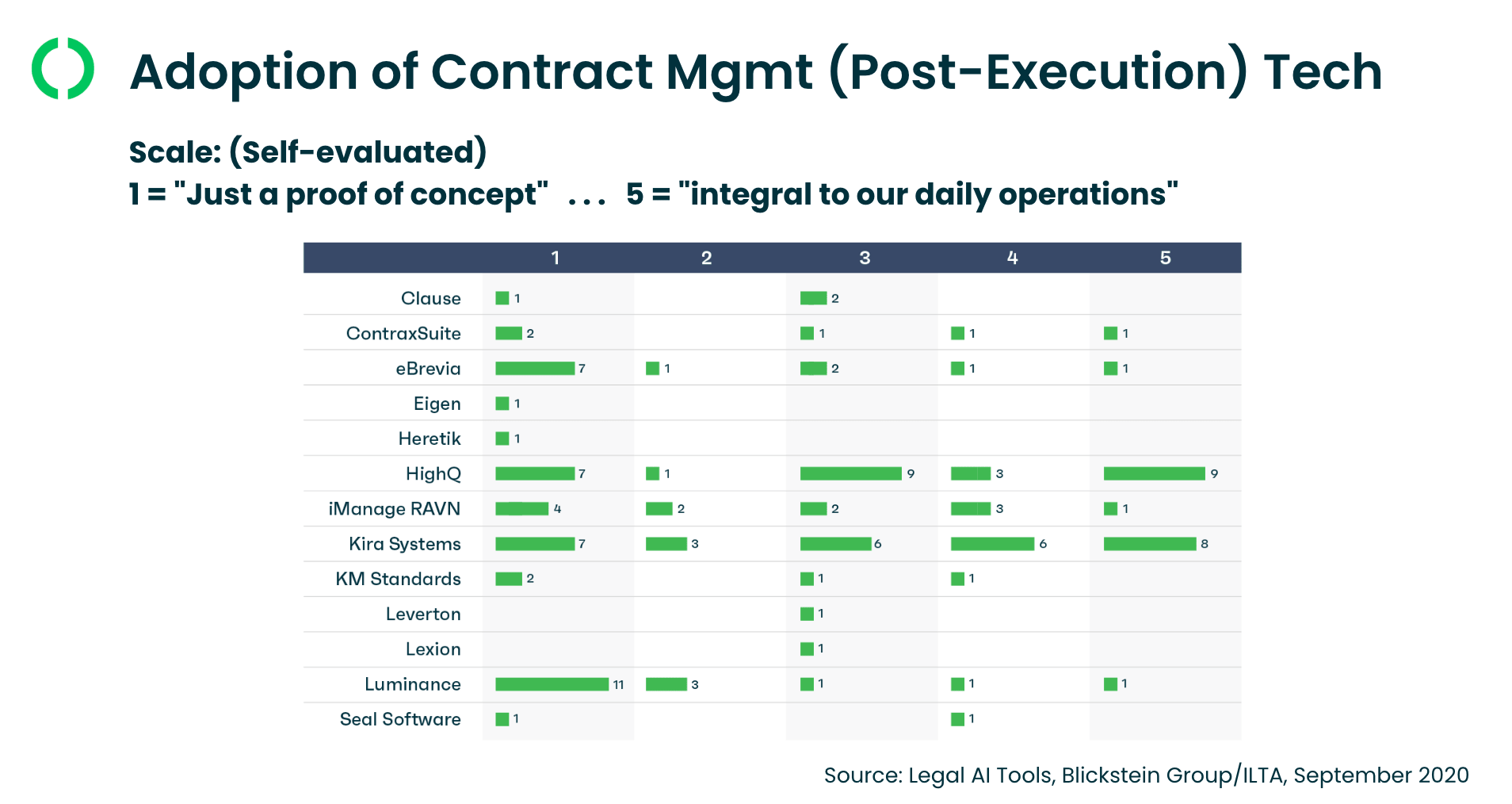

Blickstein Group’s more recent study on Artificial Intelligence adoption tackles the question of the extent to which legal organizations are just at proof of concept stages vs. full adoption and integration of AI technologies into daily operations. eDiscovery and legal research were the applications that are further along the adoption curve, according to this research, followed by pre- and post-signature contract analysis tools. While many firms are at least evaluating AI tools, for many of them adoption is not yet fully integrated, and adoption is often unevenly distributed among providers of each type of tool.

The panel added one additional lens for considering AI adoption levels. They all thought that an important signal of AI maturity was the application of AI to discrete projects within firms. That might be projects that use AI to normalize data sets, especially leveraging a firm’s own data to gain insights about the business and about client matters. What’s market and deal point studies are among the applications for this type of analysis. That awareness of the value of a firm’s own data, and the effectiveness of AI as a way to extract insights from that data, is as much an indicator of maturity as the adoption of specific AI based products for defined use cases.

Future Hot Spots

The panel took some time to think about the future of legal tech, and identified a number of trends they thought we can expect to pick up speed in coming months and years:

- Better interoperability - The industry sometimes seems awash point solutions; the panel hopes for better integrations between the various systems that lawyers and firms use, and solutions that work more easily “right out of the box.”

- Self-Service - There was agreement that more client-facing solutions were likely, especially those built on “low-code / no-code” solutions that capture processes and deliver value directly to clients.

- More tech delivery through ALSPs - Côté noted that larger firms have the capacity to track legal tech and develop their own solutions, but more tech-based work might be delivered through captive ALSPs, or through external ALSPs as we’ve seen in the eDiscovery space.

Geographical Differences in Legal Innovation

The consensus of the panel was that legal technology and innovation, while moving forward everywhere, is uneven and somewhat fragmented globally.

Shaver, whose legal career has taken her from Australia to Canada to the US, pointed out that while the US has been the source of a large share of the new tools being used in technology, smaller markets such as Australia tend to show more takeup of technology and more mature innovation efforts. In the US, “adoption is not proportional to availability” of legal tech, so there is a certain unevenness in legal innovation across the US.

Hunt and Côté cited the unique, concentrated legal cultures in their respective cities as a contributor to innovation there. In London, Hunt noted, there is a large concentration of firms in a small square mile of the city. While there has been plenty of genuine innovation and tech adoption, for many firms there has been a sort of arms race to at least seem innovative, sometimes without a lot of substantive gains. More recently, however, he sees more and more well-defined innovation roles and innovation teams that are driving substantive changes.

Toronto has a similar concentration of firms, noted Côté. The firms centered on Bay Street share a collegiality and healthy rivalry that has kept many firms looking out for what’s new. In addition, Toronto enjoys a solid infrastructure in the form of legal tech accelerators; a new law school (Ryerson) with a focus on innovation; a generally tech-intensive regional economy; and the presence of several legal tech companies, including Kira Systems.

Betting on Growth

Finally, the panel was asked to identify a technology or innovation that they thought would achieve ubiquity in the market. Their top picks:

- Nicola Shaver: Expert systems, especially those built on low- or no-code systems, will become a ubiquitous delivery channel for legal services.

- Ben Hunt: Given that so much of our legal world revolves around transactions, platforms to aid transaction management will be making a lot of lives easier.

- James Côté: In general, the types of solutions that will become more important are those that take the messy data that lawyers work with, and make sense out of it. So Natural Language Processing and related tools will make a big difference going forward.

Watch the webinar, “The State of Technology & Innovation in Legal: A Discussion With Experts From Around the World” on-demand now.