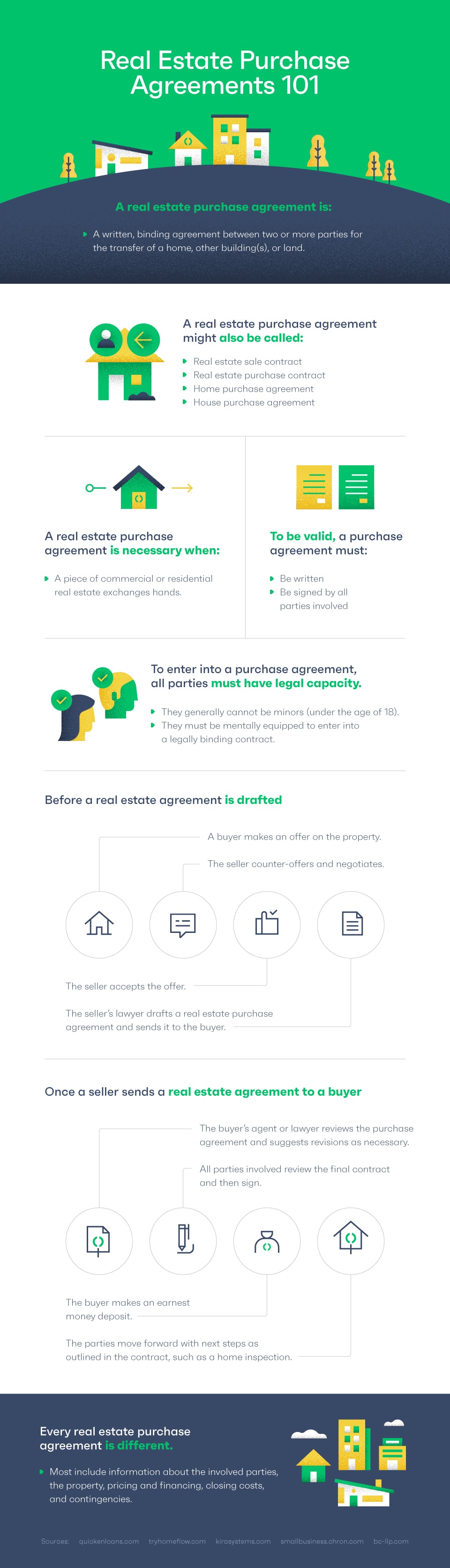

When a piece of commercial or residential real estate exchanges hands, this process requires the execution of a real estate purchase agreement.

A real estate purchase agreement could also be called a sale contract or purchase contract. It is a written, binding agreement between two or more parties for the transfer of a home or other real property. Real property is a legal term for what is essentially unmovable or fixed property, such as land or buildings. It is distinct from personal or movable property such as jewelry, books, wine, or anything else that can be transported.

Because real property is often of high value, certain protections must be put in place when it exchanges hands. These protections lead to detailed contractual commitments that are far more complicated than typically seen, for instance, in an employment contract. This article summarizes the types of clauses typically found in purchase agreements and addresses some frequently asked questions about these agreements.

Requirements for a Real Estate Purchase Agreement

Real estate purchase agreement contracts are often high-value transactions that are intended to be long-term. Because of the high stakes, states impose certain legal requirements on these contracts to memorialize the agreement in case of a dispute later on and to make sure the parties understand the agreement. These requirements include the following.

- The parties must have legal capacity.

The parties to the contract purchase agreement must have the legal capacity to enter into it.

Generally, minors (individuals under the age of 18) do not have the legal capacity to enter into a real estate contract, and any contract they enter into can be voided. If there is a dispute, a court can rule to cancel the contract.

For example, if the seller of a property is 16 and transfers the property to a buyer, a court can later rule that the transfer was without effect, and the property remains in the hands of the 16-year-old seller — even months later and even if money and property has changed hands.

A court can also void a contract if they deem a party to be mentally incapacitated. Whether an individual has mental capacity is not as straightforward as determining whether an individual is a minor. In most states, a court will look to whether an individual was unable to understand the agreement’s terms because of brain disease (such as dementia), low IQ, or other factors. If the individual could not be expected to understand the agreement’s terms, the contract can be voided.

2. The purchase agreement must be in writing and must be signed by both parties.

Nearly all real estate purchase agreements must be in writing and signed by both parties in order to be enforceable. In other words, a verbal agreement and a handshake will not be enough to convey an individual’s interest in real property. This requirement is in place because of a legal doctrine called the Statute of Frauds. The Statute of Frauds is meant to protect both the purchaser and the seller in contracts that are of significant value by requiring that the terms of the contract be memorialized.

Without the Statute of Frauds, for instance, a purchaser could claim that the buyer verbally promised to sell their home for $100,000. The buyer may insist they said they would buy the house for $50,000. Without a written contract, it is difficult for a court to assess the truth, and both mistakes and fraud become more likely. Written contracts signed by both parties reduce these risks.

The Contents of a Real Estate Purchase Agreement

While no purchase agreement is exactly the same, a number of components appear in most agreements.

Names and contact information

In order to avoid confusion as to what property is being sold and to whom, a real estate purchase agreement will include information such as the buyer’s and seller’s full names, addresses, phone numbers, and any co-signers.

Property description and essential details

The property must be described in detail, including the address as well as a clear legal description of the property. A legal description of a property identifies the particular lot and the legal boundaries of the property. It can be found in previously recorded deeds.

The purchase agreement should also set forth, with specificity, what will be included in the sale. Will the home come fully furnished? Is the seller including some furniture but not other pieces? Are wall hangings included? Kitchen appliances? All inclusions should be specified.

Pricing and financing

A real estate contract generally sets forth pricing and financing information. Most buyers do not pay for a house in cash; instead, they require some sort of financing (a loan). The agreement will lay out the specifics of the loan — for instance, whether the buyer is obtaining a mortgage to pay for the house.

Closing costs

In any real estate transaction, there are closing costs. Closing costs cover the expenses that are part of most real estate transactions, including application fees to the lender, origination fees, credit reports, appraisal fees, attorney fees, escrow deposits, home inspection fees, lead-based paint inspection fees, survey fees, recording fees, and more.

Although the buyer typically pays for fees relating to the loan, and the seller typically pays for the real estate agent’s commission and other fees relating to the transfer of property, the parties can negotiate closing costs. The purchase agreement should stipulate who pays for what.

Closing date and date of possession

The closing date is the date when the parties meet to sign the final paperwork that completes the transfer of property. The closing date should be included in the purchase contract, either as a set date or, more often, as a looser “closing on or before X date unless a change is mutually agreed upon by the parties.”

It is not uncommon for parties to push the closing date because of problems with the appraisal, difficulties in scheduling, or other concerns. A flexible closing date is generally, though not always, preferable.

Possession of the property does not always transfer at the time of closing. If possession occurs before or after closing, the parties will need to create a pre-closing or post-closing possession agreement.

For instance, if possession occurs pre-closing, the seller will likely want terms that stipulate the property will be accepted in the condition it was as of the possession date. If possession occurs post-closing, the seller will likely be expected to pay rent to the buyer. These terms should all be memorialized in the contract.

Earnest money

A purchase contract should note any earnest money put down on the property. Earnest money, which is also known as a good faith deposit, is a small percentage of the selling price (usually between one and three percent) that the buyer puts down to show that they are serious about buying the home. The earnest money is meant to give the seller confidence that the buyer is serious about the purchase.

If the buyer backs out of the agreement after entering into the purchase agreement and before closing on the home for a reason that is not stipulated in the contract, the buyer forfeits the earnest money.

Generally, the money is held in escrow by a third party and is credited toward a down payment on the house or closing costs. The contract should specify the amount of earnest money, how it will be held, and what the money will be applied to.

Contingencies

Contingencies are another important part of purchase agreements. Contingencies set forth the conditions or actions that must be met in order for the agreement to become binding.

One common contingency gives the buyer time to obtain an inspection of the property. If it turns out during inspection that termites have infested the home, for instance, then the potential buyer can choose not to buy the home (or request repairs, seek a reduced price, or move forward anyway).

Another common contingency is a financing contingency, which predicates the sale on the buyer’s ability to obtain a mortgage or other financing. A third type of common contingency is an appraisal contingency: If a home is being sold for more than the appraisal value, the buyer can back out, or the seller can revise the purchase price or pay for more of the closing costs.

If the conditions of the contingencies are not met, the contract becomes void and a party can back out without legal consequences. However, if all contingencies are met and a party still backs out, the contract is considered legally enforceable and the party backing out would be in breach of contract.

Real Estate Purchase Agreement FAQs

Here are some of the most common questions people tend to have about real estate purchase agreements.

1. Can a buyer cancel a purchase agreement?

Sometimes, even if everything in the sale is going well, inspection passes, the appraisal comes back over purchase prices, and all contingencies are met, the buyer will want to back out. Perhaps the buyer found another home that was a better fit, lost their job, or just had a change of heart.

Buyers can back out of a purchase agreement. However, because these are binding contracts, there will be penalties. When a buyer backs out, generally they must forfeit the earnest money (discussed above).

2. Can a seller cancel a purchase agreement?

Like buyers, sellers can sometimes change their minds about a purchase agreement. Maybe they had seller’s remorse, could not find another home, or had other personal reasons for not wanting to sell.

It is decidedly more difficult for a seller to cancel an agreement than a buyer. Generally, the best path forward is to force the buyer into cancelling the agreement. For instance, if a contingency is not met (perhaps the inspection showed some repair work that needs to be done), the seller could refuse to do the work or to lower the price of the house. Some contracts also allow a short period for an attorney to review the contract, usually three to five days from the signing of the contract. A seller can usually cancel based on an attorney’s review of the contract.

If it is past the attorney review period or the buyer does not want to opt out of the purchase, the seller is somewhat stuck. If the seller attempts to cancel the deal, a court may order specific performance for breach of contract. Specific performance means the terms of the contract need to be carried out as if there were no breach — in other words, the real estate transaction needs to go through. A buyer could also sue for damages caused by the breach, which can be substantial — these could include legal fees, inspection fees, temporary housing costs, storage costs, and more.

The breach of contract runs not only with the buyer but can run to the listing agent as well. If a seller cancels a contract with the agent before closing, the agent can sue for marketing costs, such as the costs of photography, staging, advertising, and open houses.

3. Can a purchase agreement be amended?

Changes to the purchase agreement are not uncommon. The closing date may change, the type of loan the buyer receives may change, the purchase price may need to be amended due to the appraisal, and so forth.

When circumstances change and terms need to be modified, the parties can usually amend the purchase agreement as long as both parties agree, they memorialize the changes in writing, and they sign the contract in front of a notary.

Conclusion

Real estate purchase agreements are complex because both the buyer and seller have a lot at stake. Developing a solid purchase agreement, complete with tried-and-true clauses that have stood the test of time (and endured in courts), can save significant aggravation and court fees down the line.